A Forecast of voluntary Carbon Credit price over the next 30 years

A review of Ernsts and Young: Net Zero Centre's forecast of carbon credit prices

This blog post highlights a great research report done by Ernst and Young’s Net Zero Centre called “Essential, Expensive and evolving: the outlook for carbon credits and offsets.” This report is extremely informative, I highly recommend a full read. However at 58 pages it might not be for everyone. I started to write the blog post by giving a background on what is Carbon Credits. However proved to be just a bit too much. So I’m going to assume you know what a Carbon Credit is and just get to the meat and potatoes.

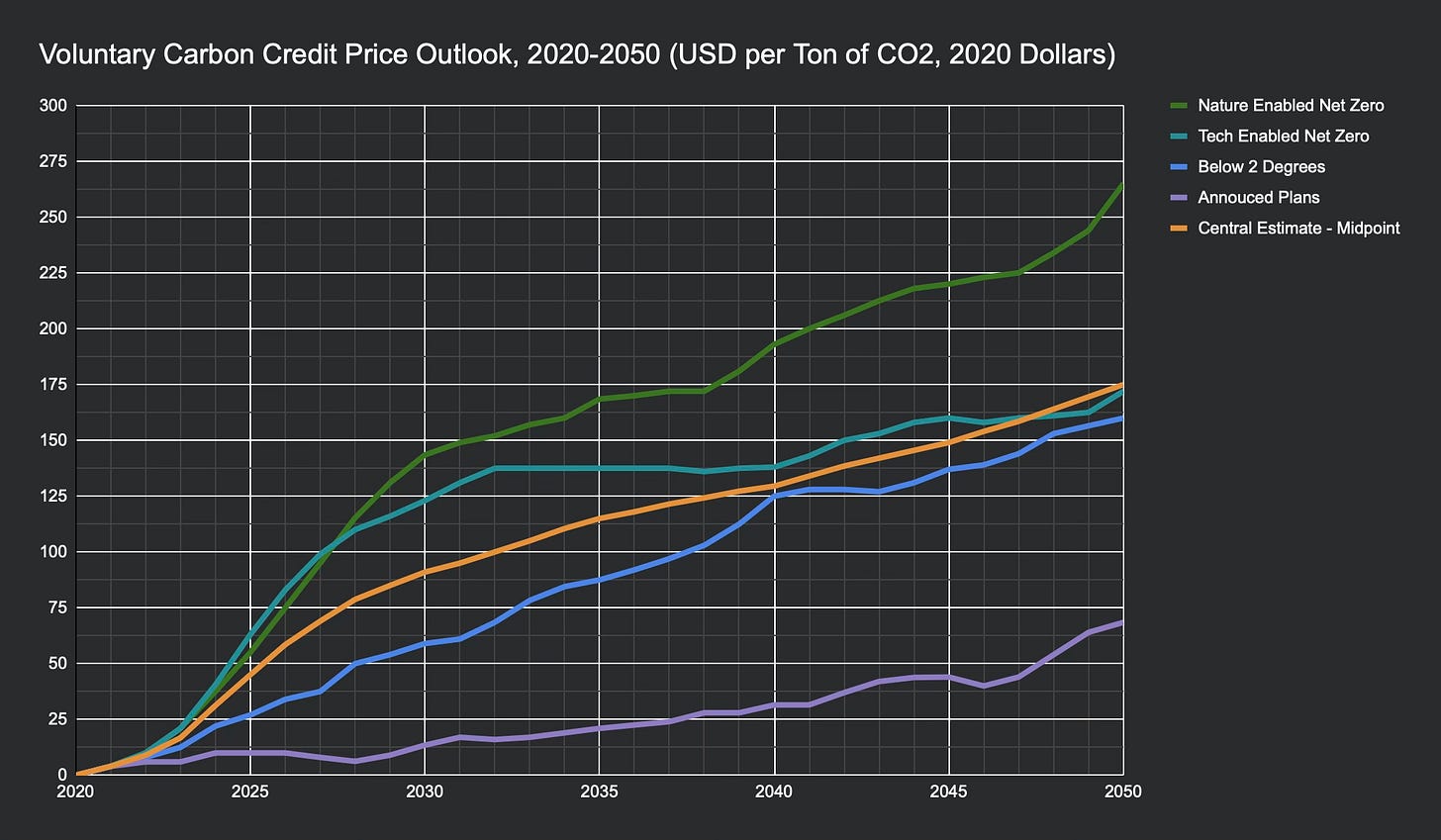

A price forecast for Voluntary Carbon Credit Markets

Probably the single biggest takeaway from the report, is a forecast of where the voluntary Carbon Credit markets will be in the future (see page 34 of PDF). The forecasts provides 4 distinct scenarios of the future. Which is smart, because, obviously, there is a lot of uncertainty around how climate change will play out. Their report provides more detail on the various scenarios and the assumptions underlying, however for purposes of this blog. I simply wanted to get to a single value for each year. In their original report they provide a “central range”. I like their approach. In fact, most of the time I prefer ranges, but for the purposes of coming up with a ‘single forecast’ I chose to take the mid-point of E&Y’s central range. I added this value in orange.

So there you have it. An interesting projection of future Carbon Credit prices in the voluntary market.

How to use information?

Probably the best use of this information is to ncorporate it into financial models on various projects. This could be done for a variety of projects but most of the voluntary Carbon Credit markets right now focused on nature based solutions. Like restoring or conserving forests, or wetlands.

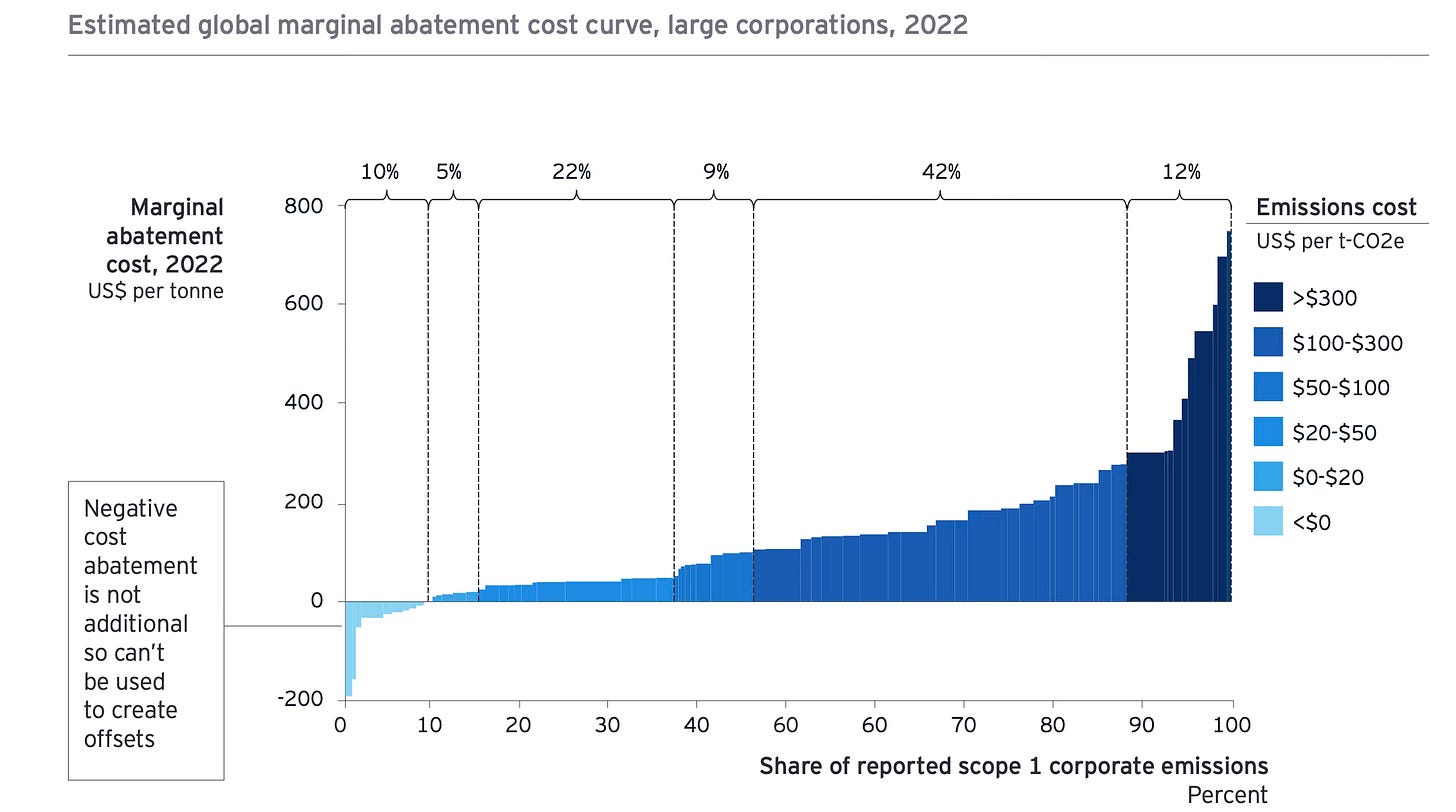

Global Marginal Abatement Cost Curve

This next Gem is located in the Appenix (p. 56), but I think is fascinating. It highlight all the available emissions reductions options and then orders it relative to the lowest cost options and the highest cost options.

This in effect shows how ‘difficult’ it will be to extract various emissions from the atmosphere. Notice that a good 60%+ of the missions can be extracted at $200 per ton of CO2. However, the cost curt takes a sharp upward turn as you stretch into the 90% range. The implication is that it will be very expensive to abate that last bit of CO2 (upwards of $300 to $800 US per ton).

Summary

Experts in these projects will tell you that there is still a wide range of prices even today on any given Carbon Credit project. Future blog posts might explore the variation in CO2 prices across different present day projects.

Sources

Ernst and Young Net Zero Centre - The group who published the report.

“Essential, Expensive and evolving: the outlook for carbon credits and offsets” - A PDF of the report.